When CryptoPunk #2386, one of the rare 24 Ape Punks, sold for a mere 10 ETH on September 11, 2024, the NFT community was stunned. Amidst the laughter and disbelief, questions arose: How could this happen? What went wrong? The answers lie in the complex world of fractional ownership and smart contract code. This is the story of CryptoPunk #2386, and it holds crucial lessons for the future of NFTs.

The Journey of CryptoPunk #2386 on NIFTEX

On September 26, 2020, Punk #2386 was fractionalized by MrTPunks on the NIFTEX platform, founded by Joel. It's important to note that NIFTEX itself isn't a fractionalized NFT collection, but rather a protocol for fractionalizing individual high-value NFTs or larger NFT collections. This distinction is crucial for understanding the platform's role in the CryptoPunk #2386 saga.

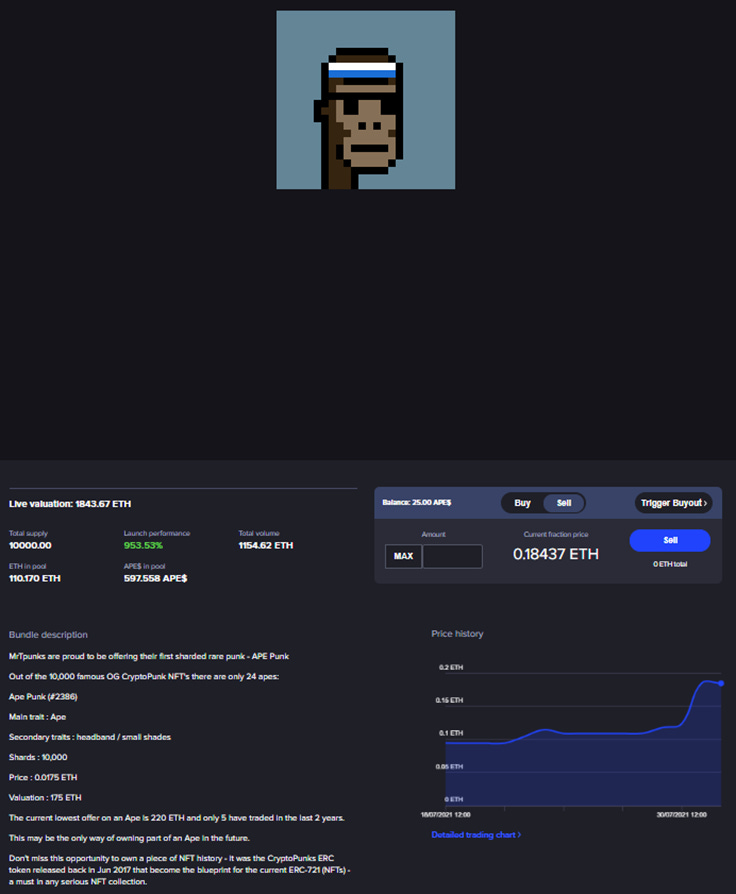

The fractionalization of Punk #2386 began with an initial valuation of 175 ETH. A total of 10,000 shares were created and distributed as APE$ tokens, each priced at 0.0175 ETH. This structure allowed a broader range of investors to own a piece of this rare digital asset.

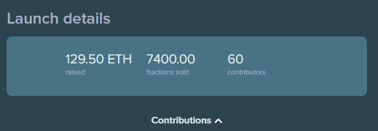

The launch was a success, with 60 early believers in the space contributing a total of 129.5 ETH to acquire 7,400 APE$ tokens. For these 60 adventurers, owning a piece of thai grail CryptoPunk was an golden opportunity that they couldn't pass up. They saw fractional ownership as the future, a way to break down barriers and share in the success of the NFT revolution.This is why, given such a valuation, I immediately aped in to become one of the key holders of this grail piece on the launch of NIFTEX back in 2020.

Two Significant Buyout Attempts

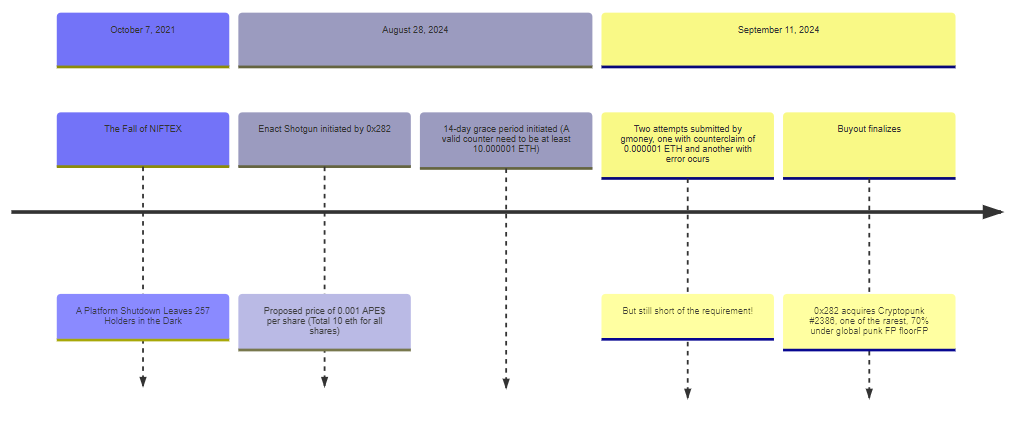

The journey of CryptoPunk #2386 is marked by two notable buyout attempts:

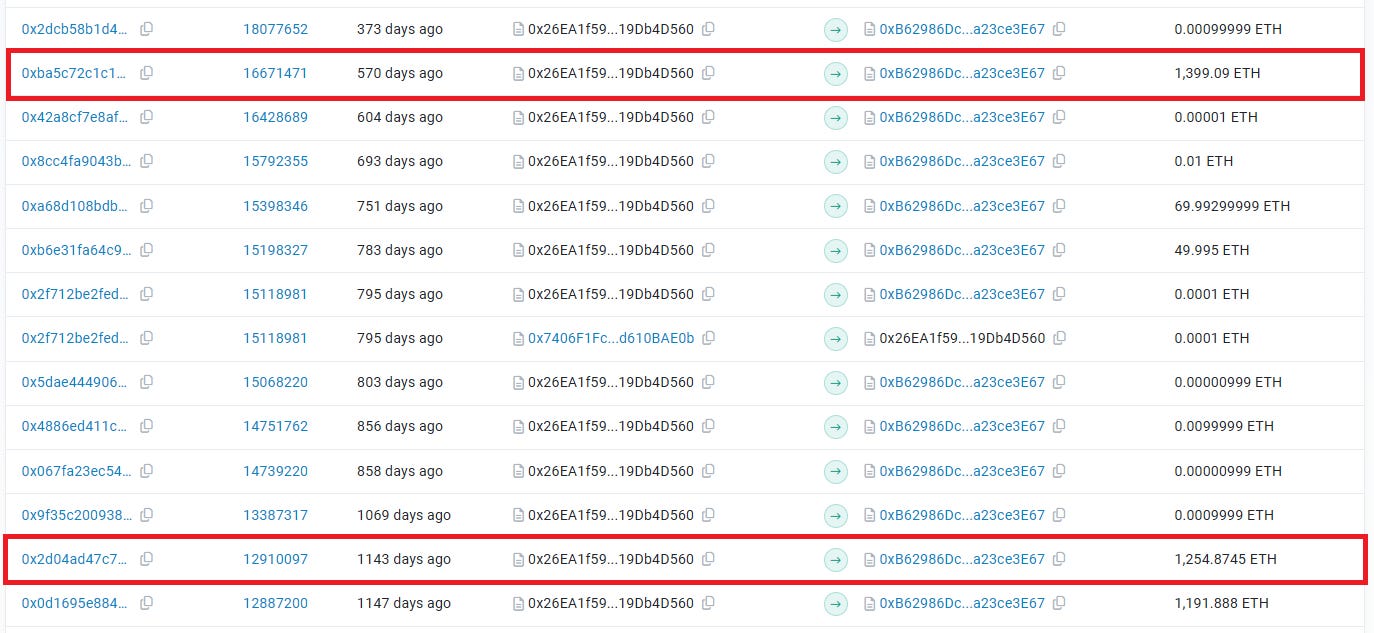

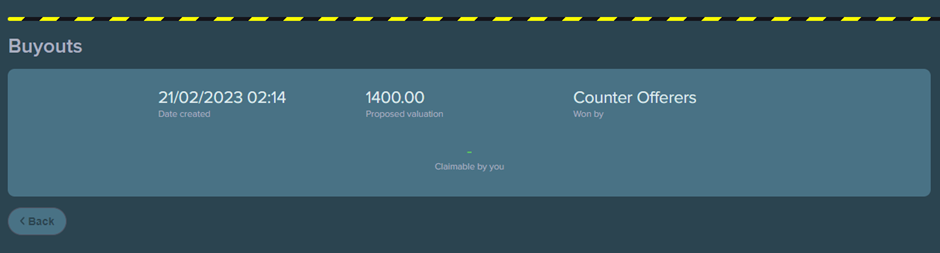

On July 27, 2021, renowned rapper Snoop Dogg proposed a buyout at approximately 1250 ETH (link), but this offer was rejected by the holders. Later, on February 20, 2023, another buyout was proposed at 1399.09 ETH. However, the holders countered with a valuation of 1400 ETH, demonstrating their strong belief in the value of their fractional shares.

These buyout attempts highlight the tension between individual ownership and collective decision-making in fractional NFT projects. They also underscore the conviction of the APE$ token holders, who believed in the long-term value of their investment.

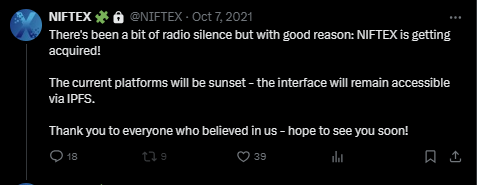

The Fall of NIFTEX: A Shutdown Leaves 257 Holders in the Dark

On October 7, 2021, the NIFTEX platform, which enabled the fractional ownership of CryptoPunk #2386, abruptly shut down, leaving the 257 token holders scrambling. Even the IPFS cloud platform hosting records of buyout attempts became inaccessible. Following the shutdown, the site tracking buyouts frontend disappeared, leaving direct interaction with the smart contract as the only option. This situation turned the platform into a playground for blockchain Chads and hackers.

Anatomy of the CryptoPunk Coup: Tech Dive into Enact Shotgun

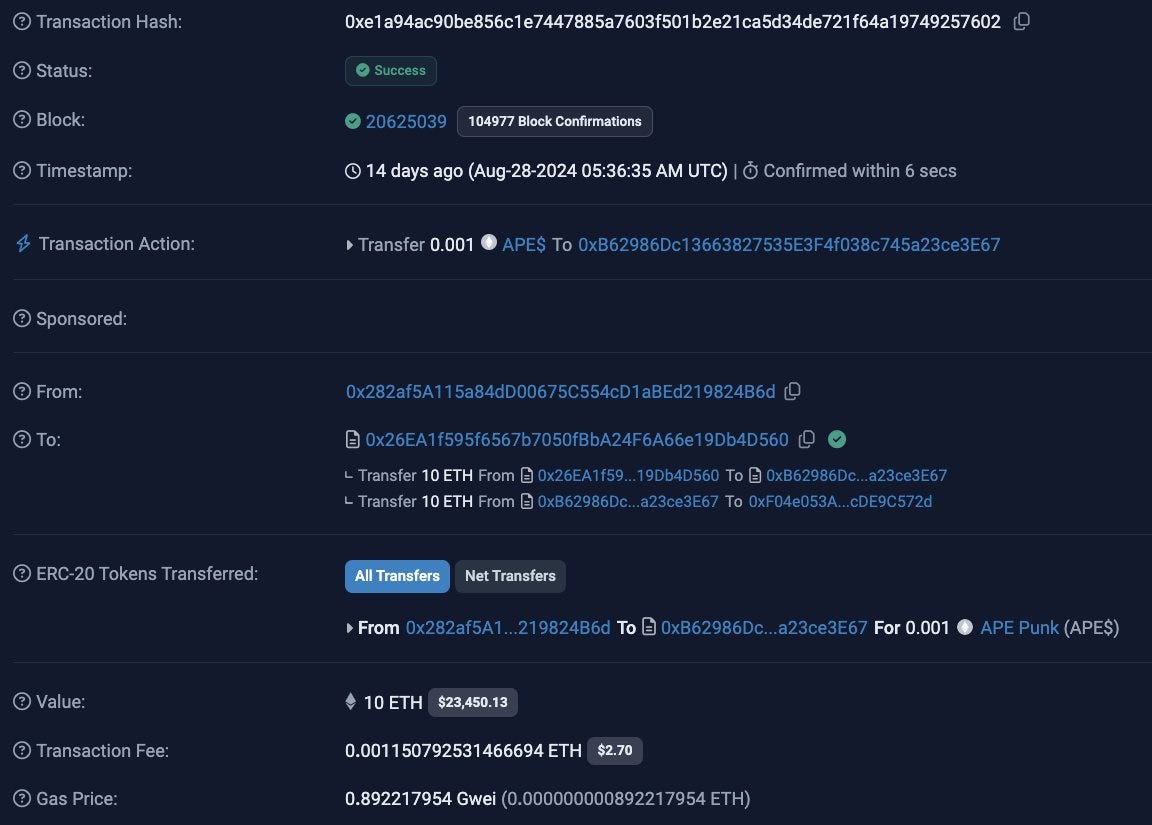

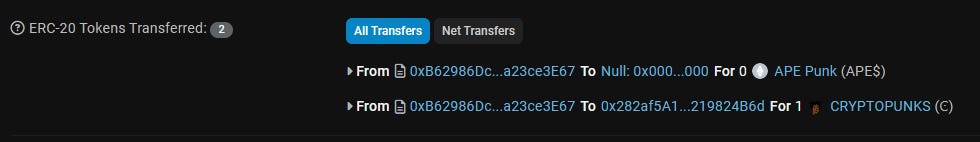

The tale of CryptoPunk #2386's shocking sale begins on August 28, 2024, when the mysterious 0x282 initiated the Enact Shotgun contract. Their proposed buyout price? A mere 0.001 ETH per share, totaling just 10 ETH for this grail piece.

The contract's rules were simple: once a buyout is proposed, a 14-day grace period initiated. During this grace period, shareholders can either accept the offer or outbid it to block the acquisition.

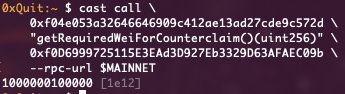

But here's the kicker, as explained by the 0xQuit. To successfully block the buyout, you couldn't just offer any old price. You had to beat 0x282's offer by purchasing their committed shares at a higher price. And not just any higher price, but exactly 0.0010000001 ETH per share, as per the shotgun contract's rules. That's a total of 10.000001 ETH.

Fast forward to September 11, 2024, mere hours before the deadline. gmoney makes two attempts to submit a counteroffer. But alas, the first falls short at 0.000001 ETH/share, and another contained an error, still failing to meet the required threshold.

The clock strikes 06:36:47 PM UTC, the grace period ends, and the unthinkable happens. With no successful block, 0x282 walks away with the deal of the century: 1 of just 24 Ape Punks, snagged for 70% below the global floor!

Lesson learned from NIFTEX: Mitigating Fractional NFT Risks

The rise and fall of CryptoPunk #2386 offers critical lessons for the entire web3 ecosystem on improving risk management practices:

Platform & Founder Due Diligence

Maintain operational continuity: Ensure a proper frontend website remains accessible even if the platform is decommissioned, allowing holders to interact with their assets.

Comprehensive documentation: Develop robust Docs, FAQs, and learning resources that clearly explain contract mechanics, risks, and operational procedures.

Ethical responsibility: Founders must recognize their ethical obligation to users, understanding that their actions (or inactions) can have severe consequences, as seen in cases like LUNA and 3AC.

Community Engagement

Establish communication channels: Since NFT is highly community driven, a dedicated community spaces (e.g., Discord, Telegram) for feedback, decision-making, and coordinated action is a must.

In the absence of official channels, holders should self-organize to stay informed, surface concerns, and coordinate protective actions like buyout defense.

Robust Smart Contract Risk Management

Stress testing: Critical smart contract mechanisms like Shotgun clauses must be rigorously designed, tested under diverse scenarios, and have their risk tolerances validated.

Open-sourcing code and implementing bug bounty programs can surface vulnerabilities, failsafe circuit breakers should be designed into contracts to gracefully halt activity when risk thresholds are breached.

Caps, speed bumps, and other guardrails can help prevent exploitative behavior.

Holder Education & Responsibility

Holders bear ultimate responsibility for understanding the assets they own and the risks they entail. Not Your Key, Not Your Coins

Holders should build relationships with one another to self-organize in the absence of official channels. Collective action is critical.

While the acquirer 0x282 may not be a malicious hacker, their actions reveal a sophisticated understanding of the NFT ecosystem. Evidence suggests 0x282 is likely one of the 257 fractional holders, possibly an early CryptoPunks and Meebits holders with significant experience in NFTs, DeFi, and NFTFi. This raises critical questions about insider knowledge, the sale's proceeds, and the fairness of the acquisition price.

Nevertheless, the ultimate takeaway is clear: a sustainable future for fractional NFTs and the broader web3 ecosystem depends on a multifaceted approach. This includes responsible platform stewardship, proactive community engagement, rigorously tested smart contracts, and most crucially, empowered and educated token holders. Only by addressing these interconnected factors can we build a more resilient and equitable decentralized future.

Disclaimer: This is not financial advice. The content in this article represents only the personal views of the original author and is intended for discussion, sharing, and education purposes only. DYOR (Do Your Own Research)

If you enjoyed this article, make sure to hit 'Subscribe Now' at the bottom of TheBabyApe's website to get our next deep dive straight to your inbox!

Support The BabyApe Web3 Brand + Content by donating to one of the addresses below:

ETH: 0xAf4Bc9CfAcaa8EFAee877Cb0CaEa451F8707AC18

SOL: 2AUgaq9Q5fSJtxEduNZGMxqgY7xXV1f1YD5DW95U6M92

BTC: bc1p8y0yfwj29ve9vn5dq9j52elxmemz43nl3ms3vss3gcs0kj8atymsr0us84

Till next time, I'm The BabyApe. Stay curious, stay humble, and invest responsibly!